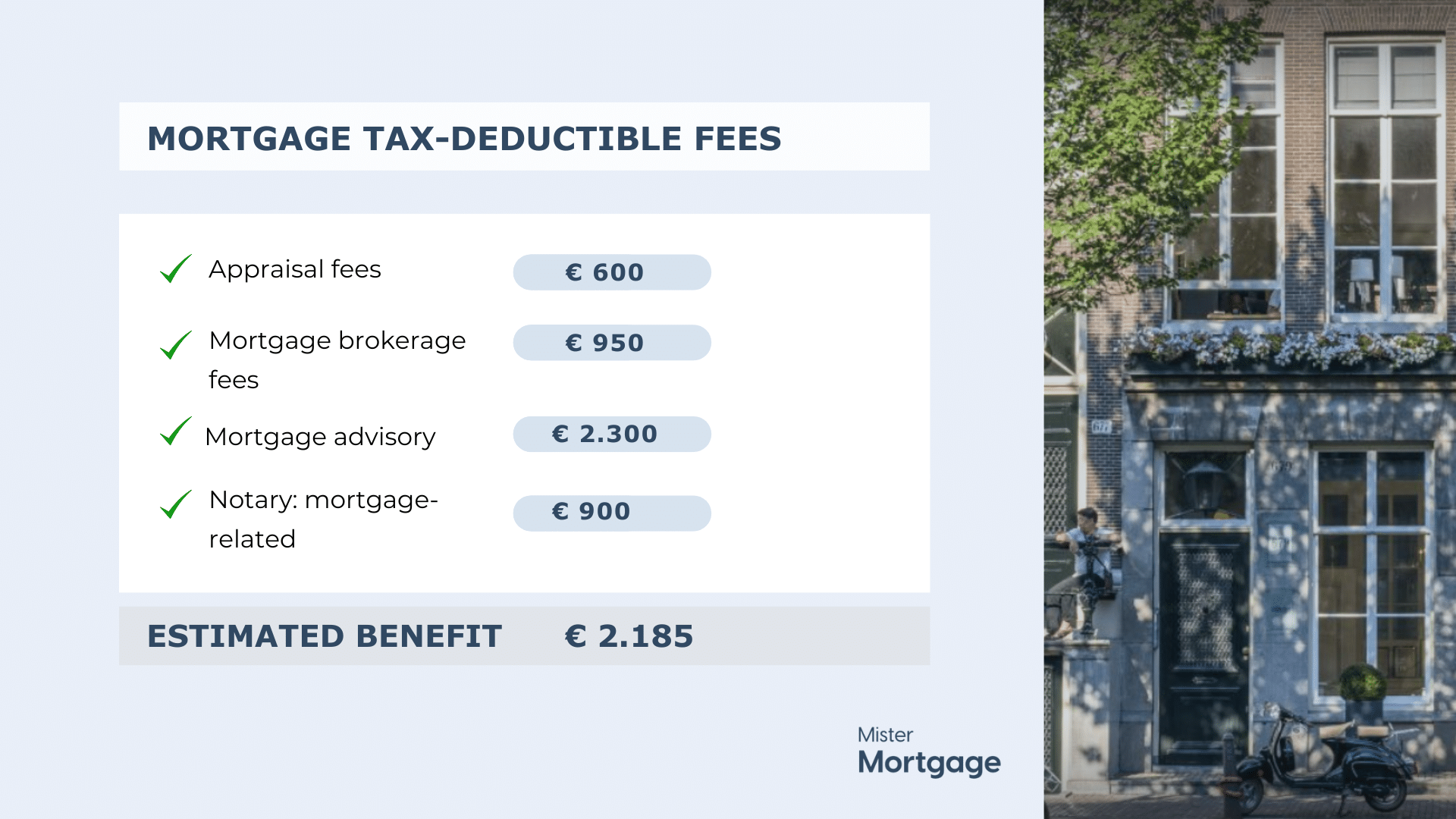

One of the benefits of the Dutch system is that some closing fees are tax-deductible in the Netherlands. A week before you need to sign a mortgage deed, your notary sends you a list of closing fees you must pay to secure a mortgage.

However, not all the costs are tax-deductible on the final invoice. You can get approximately 40% back when you file a provisional income tax return the following year to receive your tax return.

-

Appraisal fees. The property assessment costs focus on the expenses incurred to secure a mortgage.

-

Translation costs.

-

Mortgage interest rate.

-

The mediation costs refer to the expenses you face while securing a mortgage or loan, including mortgage advice.

-

National Mortgage Guarantee (NHG) fee. This is only eligible for deduction when buying a house, not when refinancing the mortgage.

-

The notary fees for the transfer deed (or title deed) and the cadastral duties for the mortgage deed, including VAT.

-

The interest on construction during the period after finalizing the provisional purchase/construction agreement, which includes deferment interest, is applicable only to newly constructed homes.

-

Fees for potentially extending your mortgage quote: If you allow your quote to expire, the interest rate at that time might be higher than the rate in your original mortgage quote. You can choose to extend your quotation for a fee, known as a commitment fee.

-

Ground rent involves regular payments, either monthly or annually, for the use of land.

Schedule a free call today with us