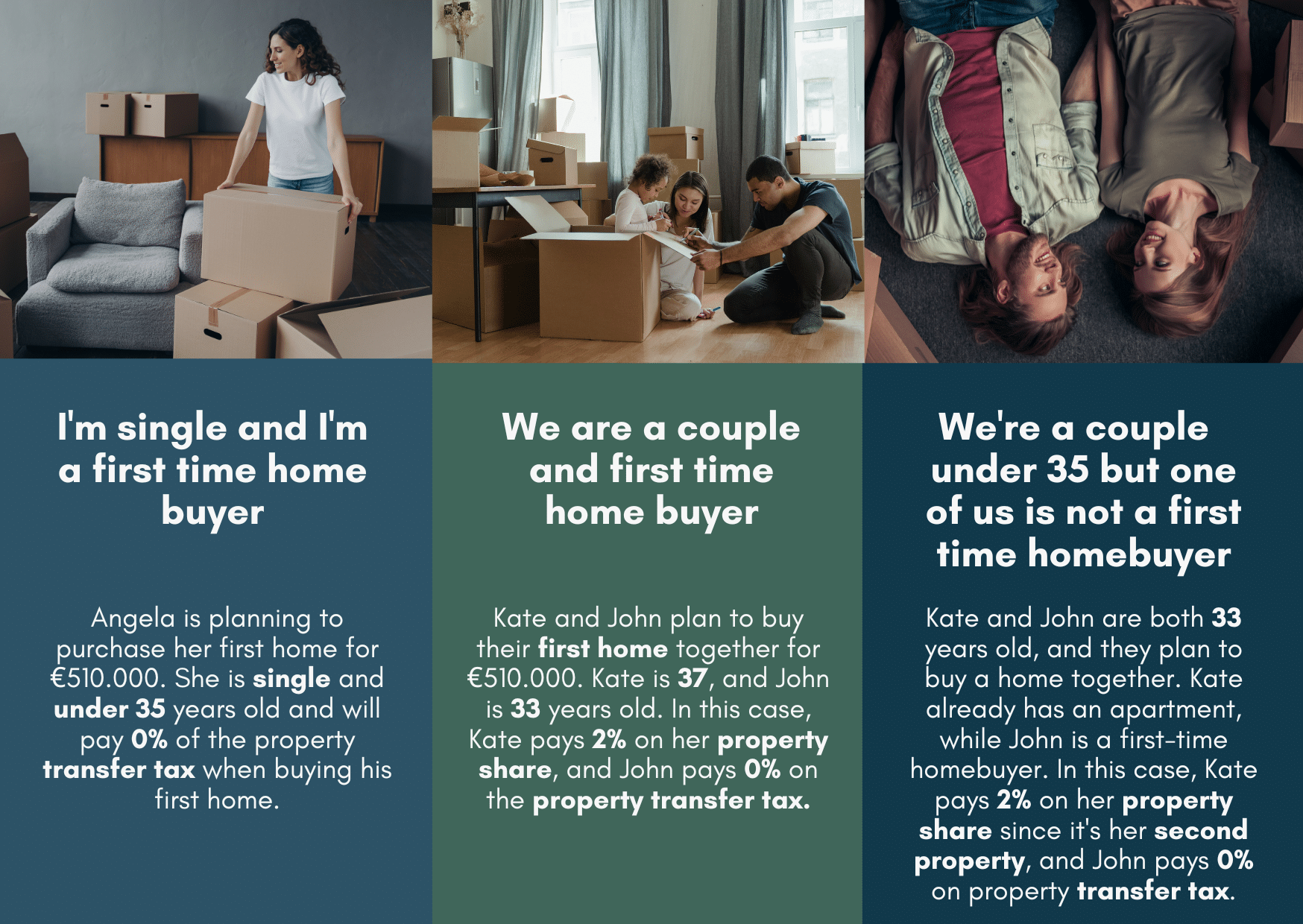

Homebuyers aged 18 to 35 who buy their first property worth up to € 510.000 can benefit from an exemption of the 2% transfer tax in 2024.

You need fewer savings to close your mortgage, and you can keep more of your savings in your pocket. The property transfer tax (overdrachtsbelasting) is 2% of the purchase price. If you buy a residential property in the Netherlands, you must pay 2 per cent of the property price on tax.

For example, if you buy a home worth € 510.000, you must pay the transfer fee of € 10.400. First-time home buyers who are under 35 years old and buy a property for less than € 510.000 will save € 10.400. If you can benefit from this exemption, you need fewer savings to close your mortgage.

Rise in transfer tax for buy-to-let investors

The property transfer tax for buy-to-let investors has been adjusted to 10.4%. The shortage of housing is a prevalent issue in some Dutch cities. To address this, the Dutch government is reducing costs for first-time buyers while increasing taxes for investors, seeking to establish a fairer landscape for first-time homebuyers in the Netherlands.

The Dutch government thinks that people who are buying their first home and those who invest in homes often want to buy houses that cost about the same. For this reason, the Dutch government increased the transfer tax and introduced a purchase protection act.

| Type of buyer | Residential | Other real estate |

|---|---|---|

| First-time buyers (age between 18-35 years) | 0% | 10.4% |

| Moving homes (when you buy your second property) | 2% | 10.4% |

For example, if you plan to buy a commercial property, a holiday home, or a buy-to-let property, you pay a transfer tax of 10.4%. If you decide to move houses, you pay a transfer tax of 2 % for the second residential property.

Different scenarios in 2024:

Schedule a free call with our team